Is Coupang a major coup? ($CPNG)

Preface

Coupang went public through a standard IPO on March 11, 2021. It immediately rose 40% on its market debut and is currently trading at -38.15% from the closing price of IPO date. The company was founded in 2010 by Bom Kim who previously worked at Boston Consulting Group. Coupang was initially founded as a Groupon inspired marketplace with daily deals and coupons which quickly pivoted to an eBay inspired third-party marketplace. As of this writing, it’s currently trading at $29.98.

Thesis

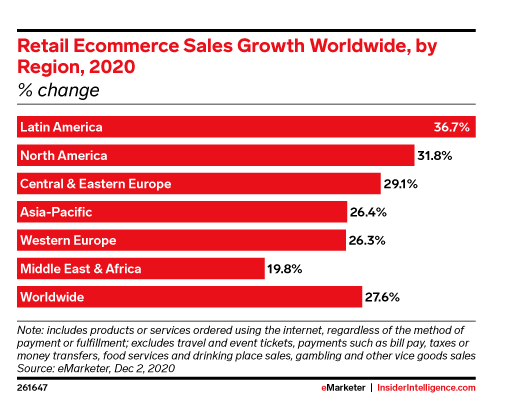

Large Total Addressable Market - Korea is the fourth largest economy in Asia and the 11th largest economy in the world as of 2021. Total spend in retail, grocery, consumer food service, and travel is expected to increase to $534 billion in 2024. Total e-commerce spend is expected to grow to $206 billion by 2024, implying a CAGR of approximately 10%. Total e-commerce spend per Internet buyer in Korea is expected to grow from approximately $2,600 in 2019 to approximately $4,300 in 2024. Despite being the leading e-commerce platform for the South Korean market, they have plenty of upside as the market continues to develop. Coupang is expected to expand into new Asian markets such as Japan, Singapore and Malaysia. Coupang will face fierce competition with Shopee (SE) and Lazada (BABA) in Singapore and Malaysia, whilst Japan is led by Amazon who only maintain roughly 25% of the e-commerce market share. Coupang’s value proposition is very much aligned to high density urban metros like Tokyo. Tokyo is the world’s largest urban area with 36M in population. If Coupang can replicate their logistics stronghold in Seoul, Japan can be a massive opportunity for Coupang.

Optionality - Since the history of Coupang, they’ve been able to pivot the business from an initial Groupon clone to an eBay style marketplace. Coupang has since morphed into a super company combining logistics, pay and marketplace in the South Korean market. The Founder & CEO has stated in an interview with CNBC:

I don’t know if I can tell you that six months from now, or six years from now, that we will look similar to what we look today.

In my opinion, this appetite for change will allow them to scale easier into new markets and add new product offerings and services as they continue to grow. Coupang has had numerous job postings online and recently had trademarks submitted for Coupang Global Fulfillment and Coupang Global services, hinting a move is on the horizon.

Growth At Scale - Coupang has continued to grow their revenue by more than 50% for the past 15 quarters. Coupang is expected to double their revenue by 2023, which will provide significant leverage as they look to enter new markets. The pandemic has accelerated Coupang’s value proposition to an already sophisticated and tech-friendly population. As they continue to better monetize their existing active customer base, I believe Coupang will be able to take advantage of pricing power with their loyal customers.

Story

First off, any Coupang investor must acclimate to short-term volatility, expansion pressures and unforeseen events (fire damage at fulfilment center etc.) Coupang is an e-commerce and logistics company operating as the largest online marketplace in South Korea with grand ambitions to expand into other Asian markets. I believe Coupang has a dominative strategy encompassing marketplace, logistics and pay. Coupang has Coupang Eats, Coupang Pay and Rocket (delivery system which is a significant advantage over competitors like Naver). Coupang wants to be “everything” for South Korea as Bom Kim has modelled his strategy off Jeff Bezos and Amazon. That alone is a worthy investment for a burgeoning, sophisticated market like South Korea at the current valuation. Any success from further expansion into new markets is a plus.

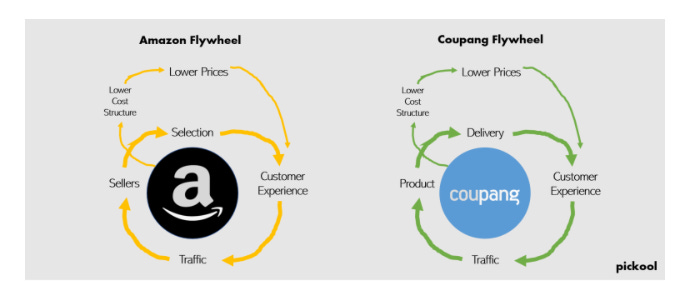

The similarities between Coupang and Amazon can be concluded with their flywheel:

Coupang’s mission statement is “how could we live without Coupang?” Their strategy is rather similar with a membership program (Rocket Wow vs. Amazon Prime) and Coupang has expanded their offerings to include 3P commerce, logistics/fulfillment, advertising and video and Rocket Fresh (grocery service). Think of Coupang as the Amazon/Doordash/Instacart of South Korea.

Historically, online shopping has forced customers to accept various compromises. E-commerce is convenient, but shipping times can be long and inconsistent. Services promising faster shipping often force us to choose from a fraction of the selection, order before early cut-off times, pay higher fees or prices, or all of the above. Post delivery, we accept the hassle of cardboard disposal and cumbersome returns as the price of e-commerce convenience. Coupang’s efforts have centered on building an end-to-end integrated system of technology and infrastructure, which allows them to deliver a superior customer experience and have a major competitive advantage. Their complete integration enables Coupang to control and improve the entire experience, from the customer app to the delivery of the order at the customer’s door, while increasing efficiency and lowering price for customers. (Source: Coupang S-1)

Coupang’s “moat” is a logistics empire where they can deliver over 90% of their orders next day and provide an unparalleled customer experience. Rather than cardboard disposal, Coupang leverages eco-friendly packaging with reusable bags. Coupang provides customers with a frictionless return policy as customers are able to place returns directly in front of their homes or return them to a delivery driver. This is a stark contrast from Amazon with wasteful packaging and a fleet of contractors. Coupang employs the largest fleet of drivers in South Korea. With such a stronghold on logistics, Coupang has started to provide third parties with access to their logistics.

The “moat” is further outlined by the CEO:

Coupang’s model is very unique because of the density of South Korea. You have 50 million+ people in the landmass the size of the state of Indiana, but when you look specifically at just inhabitable land, it’s really the size of Rhode Island, about 2,700 square kilometers. This allows Coupang to innovate on delivery in a way the world has never seen before.

Coupang’s logistics investments have paid off as 99.3% of orders placed on its site are delivered within one day. Coupang now delivers 3.3 million items each day, up from an average of 2.2 million units per day at the end of 2019.

Coupang is also on track to be the #1 private job creator for the second consecutive year, adding over 5,000 jobs in Korea in the first half of 2021. Close to 80% of jobs were created in regions outside of Seoul. Coupang has over 40,000 workers daily process and fulfill orders.

Opportunity

To truly grasp the opportunity at stake for the Coupang juggernaut, let’s examine their product and services today:

E-commerce - Coupang has over 200,000 vendors on its marketplace. Coupang provides a holistic commerce solution from store configuration to delivery. Coupang has both a 1P and 3P model. Their e-commerce platform accounts for the largest source of revenue.

Rocket Wow - Their Amazon Prime equivalent. Wow provides access to overnight delivery and other loyalty services like their video delivery service.

Rocket Fresh and Eats - Instacart and Doordash equivalent packaged into one application. Rocket Fresh leverages their extensive logistical network, whereas Rocket Eats leverages a fleet of third-party subcontractors. My guess is that once Eats develops into a larger focus for the business, it will then be integrated into their full logistic network.

Coupang Pay - Currently deployed as an easy payment solution allowing customers purchases to be processed automatically with a credit card linked to the account. Coupang Pay is currently the 3rd most active FinTech application in South Korea. One must think, they have tremendous opportunities with Coupang Pay by introducing BNPL (buy now, pay later) and reward services like co-branded credit cards etc.

Focusing on e-commerce, their value proposition is aligned to any brand/product seeking Asian expansion primarily into South Korea by two distinct offerings; third-party marketplace or branded site (myStore). Coupang allows brands to easily test out selling, shipping and buyer behaviors. They provide a high volume of traffic to the marketplace and fully outsourced logistics. myStore and Coupang Biz allow brands to build exclusive relationships with the buyers from Coupang and full control over their data and customer experience.

Coupang continues to execute with the fastest growing business segment in the world, small and medium-sized enterprises (SMEs) in their marketplace grew sales over 87% year-over-year in Q2 compared to a 7% decline for total SME offline sales in Korea.

South Korea is a very mature e-commerce market, however, I believe Coupang is still at the early stages in broad customer adoption:

South Korea has a unique demographic that make it poised for a technology-led disruption across retail, payments and logistics. These attributes include a high mobile penetration, lifestyle and fast growing personal and disposable income. As outlined by Tech Crunch, smartphone penetration is the highest globally at 96%, and internet service is reliable, fast, and cheap. Whilst these triggers may seem attractive to many competitors, to be successful, existing and new entrants must appreciate Korea’s demanding consumer preferences.

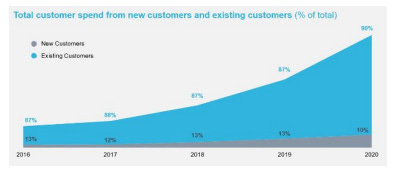

Once Coupang has captured a customer, they continue to execute at a high clip increasing their ARPU which grew 36% year-over-year as per their latest ER. Additionally, Coupang continues to expand their customer base as total Active Customers increased 26% year-over-year.

Customers are more likely to return and spend money on Coupang than other e-commerce sites. Based on dollar retention rate (or the amount of money a group spends each year after they first use a platform), Coupang customers return and spend more money than shoppers on eBay, Etsy, Walmart or Alibaba in the U.S.

The Goodwater Capital report concluded the following on dollar retention:

Customers are coming back and spending at a rate that easily exceeds those platforms and closely matches the behavior on Amazon. But more surprising is that as early as 2017, Coupang’s performance already started to exceed Amazon, with year-three dollar retention of 346% with Amazon at 278%. Later cohorts have already improved on that. The value of these customers are not only best-in-class in Korea, but likely the highest in the world.

Bom has outlined two main areas of growth. These are Rocket Fresh and Coupang Eats. He stated recently:

Both leverage Coupang’s vast logistics network and Coupang has the largest directly employed delivery fleet in South Korea with over 15,000 directly employed drivers.

It was disclosed in their latest ER that Coupang Eats revenue tripled over the past two quarters and margins are improving. Additionally, Rocket Fresh surpassed $2B in revenue run rate and grew over 100% year-over-year. Rocket Fresh is now the leading online grocer in Korea.

Finally, we cannot examine the opportunity without discussing competition and the risks it poses. Sea Limited has seen fruitful expansion efforts into Latin America and has had tremendous success in the Southeast Asian market with Shopee and Garena. Shopee has ranked number one in the shopping category in the App Store for both Taiwan and Southeast Asia. Shopee could pose a massive threat to Coupang with an entrance to South Korea and their Garena application is unmatched. Free Fire is the most downloaded mobile game globally today.

Here’s how Coupang stacks up against competitors within South Korea today:

Financials

Coupang has provided two earnings reports since being public, the latest of which saw a discriminatory drop based on an increased net loss triggered by fire damage expenses from one of their largest distribution centers.

Revenue Growth - Total revenue was $4.48B, an increase of 71% year-over-year. This was the 15th consecutive quarter of over 50% revenue growth. The consensus estimates had revenue at $4.47B. This was slightly disappointing as growth slowed in their mature offerings which are far more profitable than the fast-growing, poor margin offerings like Rocket Fresh and Coupang Eats.

EBITDA Margins - Their EBITDA margins remained roughly flat year-over-year with a slight deceleration due to direct investments in Rocket Fresh and Coupang Eats. The company claimed that their investment focus accounted for almost all the adjusted EBITDA loss which displays how profitable their more mature offerings are. (2.7%) versus (2.2%) year-over-year.

Gross Profit - Gross Profit was $658 million in the second quarter, a growth of 50% year-over-year. Excluding $158 million in inventory write-offs related to the fire at the fulfillment center in Deokpyeong, Korea (“FC Fire”), Gross Profit increased 86% year-over-year to a record $816 million.

Strategic Operational Highlights - Fresh revenue grew over 100% year-over-year exceeding $2 billion run-rate and the contribution margin improved by nearly a 1000 basis points over the last year. Coupang Eats revenue nearly tripled over just the past two quarters and the loss per order was down over 50% year-over-year.

Forward looking, without the lingering damage of a one-time event (fire at distribution center), I see potential leverage at scale for Coupang. Coupang at current estimates will likely reach break-even on an EBITDA basis by the end of 2023. With Coupang expected to reach profitability and double sales by the end of 2023, I see Coupang as extremely under appreciated today. That’s without factoring in expansion to markets like Japan, or the development of offerings outside of Eats and Rocket Fresh like advertising and Coupang Pay. Coupang’s price action has mirrored the likes of other Chinese e-commerce stocks, however Coupang does not have the risks of China attached.

EV ($49,712.92B) to sales outlook, leveraging future consensus fiscal year estimates as Coupang did not provide any future guidance:

2021 - 49.71/19.18 = 2.59

2022 - 49.71/26.95 = 1.84

Here is a benchmark of how other e-commerce companies compare, leveraging TTM and NTM figures:

With a CAGR of roughly 40% per annum in revenue from FY20-23 with positive adjusted EBITDA margins by 2023, Coupang is severely undervalued in regards to its counterparts. I would add that I believe these estimates to be fairly conservative.

Risks

Expansion fears - If Coupang is unable to scale their business into new markets such as Japan and Taiwan, they run further concentration risks to the South Korean market which could be ripe with competition in the near future. Expansion initiatives can also be difficult to manage with legislation as Coupang’s offering’s have tremendous impact on regulated areas like logistics and payments.

Unable to scale margins - In the e-commerce comparison sheet shared in the Financials section, Coupang has the lowest gross profit margins out of similar competitors. The consensus for Coupang is that their gross profit margin will exceed 20% by 2023, however, that would still rank them among the lowest of other 1P/3P marketplace competitors. A focus in low margin efforts like Rocket Fresh and Coupang Pay will only continue to add pressure in the short term. With a history of net losses, I want to see a focus on improving their leverage and profitability if they aspire to execute on costly expansion initiatives.

Growth deceleration - Coupang has had 15 quarters of more than 50% revenue growth consecutively and at some point that will end. Coupang has focused their efforts on monetization and improving their ARPU, however, their growth of the active customer base has slightly decelerated year-over-year (26% vs. 28%).

Dual Class Structure - A similar fear that I share with DraftKings and their CEO Jason Robins who also operates in a dual class structure of common shares. Bom Kim has the overarching influence on the outcome of important transactions and corporate governance matters. If issues were to arise, Bom has such control that shareholders will be unable to hold management accountable.

Conclusion

A very common proverb in the world of investing is “valuation matters until it doesn’t matter.” As a matter of fact, for Coupang it does matter. Coupang is on the verge of a “winner take most” in South Korea and has the infrastructure to duplicate their efforts in other countries and regions. Coupang has the potential to become a juggernaut of an application powering marketplace, logistics and pay. Coupang has been successful in engraining their products/services into the lives of every South Korean, that’s bigger than a “moat”. New entrants will struggle to compete with Coupang and I am confident that they can duplicate their efforts in additional markets, whilst continuing to take the lion’s share of the South Korean market. The market tends to leverage a forward looking perspective, however, I would argue their valuation does not account for Coupang’s position to continue to execute and scale in a sophisticated and technology driven market with its suite of products and applications. As such, I am currently long shares.

Disclaimer: This post is not intended as investment advice and the information provided is strictly for the purposes of research. I am not affiliated or representing any of the material that was linked in this post.